As we know, in this digital world, banks are the preferred options that cater to the financial needs of everyone. HDFC Bank is one of the prominent private banks which offers banking solutions that provide you comfort. Moreover, it was founded in 1994 and attracts millions of customers worldwide due to its innovative banking solutions. The commitment of HDFC Bank to customer satisfaction and top services enhances everyone’s experience. Furthermore, you can also benefit from the bank’s NetBanking and Mobile App. In this detailed blog, we will try to explore the services and account opening of HDFC Bank in the UAE.

Services Offered by HDFC Bank

| Account Type | Account Opening Fee | Monthly Maintenance Fee | Minimum Balance Requirement | Overdraft Charges |

| Savings Account | None | None | AED 440 (Metro/Urban) | 18% per annum on the overdrawn amount |

| NRE Savings Account | None | None | AED 440 | 18% per annum on the overdrawn amount |

| NRO Savings Account | None | None | AED 440 | 18% per annum on the overdrawn amount |

| Salary Account | None | None | No minimum balance | 18% per annum on the overdrawn amount |

| Current Account | None | None (varies by plan) | AED 1,100 to AED 4,400 (based on account type) | Varies based on account terms |

| Fixed Deposit Account | None | None | Minimum deposit of AED 220 | N/A |

| FCNR Account | None | None | Minimum deposit of AED 4,400 | N/A |

Digital and Mobile Banking

In the UAE, if you choose HDFC Bank, you can easily access NetBanking and Mobile App to transfer funds digitally. Moreover, the bank also allows you to avail of services like prepaid Forex cards that allow you to travel smoothly.

Investment and Wealth Management

The Bank allows customers to avail of services like health insurance and other policies that will be useful for them in the future. Furthermore, in HDFC Bank, you can also avail of services like portfolio investment schemes.

Must Read: Dubai Islamic Bank: Experience the Power of Halal Finance

HDFC Bank Branches in the UAE

| City | Branch | Contact No | Operating Hours |

| Dubai | HDFC Bank Dubai Branch | +971 4 123 4567 | Sun-Thu: 9:00 AM – 5:00 PM, Fri: 9:00 AM – 1:00 PM |

| Abu Dhabi | HDFC Bank Abu Dhabi Branch | +971 2 123 4567 | Sun-Thu: 9:00 AM – 5:00 PM, Fri: 9:00 AM – 1:00 PM |

| Sharjah | HDFC Bank Sharjah Branch | +971 6 123 4567 | Sun-Thu: 9:00 AM – 5:00 PM, Fri: 9:00 AM – 1:00 PM |

| Ajman | HDFC Bank Ajman Branch | +971 6 123 4568 | Sun-Thu: 9:00 AM – 5:00 PM, Fri: 9:00 AM – 1:00 PM |

| Ras Al Khaimah | HDFC Bank Ras Al Khaimah Branch | +971 7 123 4567 | Sun-Thu: 9:00 AM – 5:00 PM, Fri: 9:00 AM – 1:00 PM |

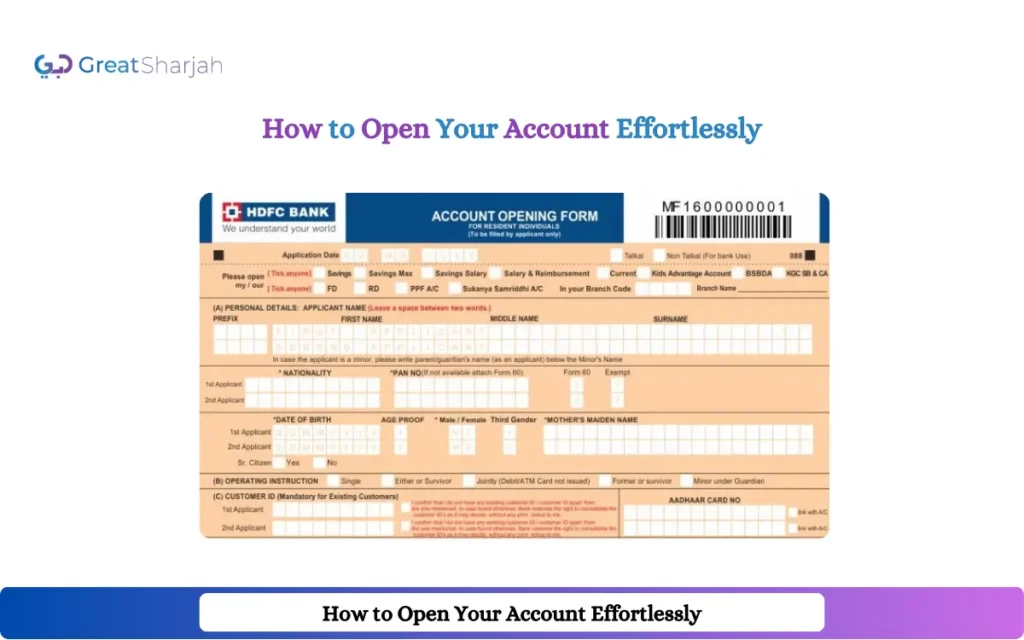

Start Banking with HDFC: How to Open Your Account

Online

If anyone is willing to create an account with HDFC Bank online then their official website is a smart option.

Visit the HDFC Bank UAE Website: To start the process of account opening, you need to visit the official website of HDFC Bank.

Select the Type of Account: After accessing the website, you have to choose the type of account that caters to your needs like savings and current account.

Click on “Open an Account”: When you select the account, simply click on the “Open an Account” section. Moreover, it typically redirects you to the online application form.

Fill Out the Online Application Form: Here you have to fill out the online application form by providing your all personal details like Full name, Address details, and nationality. Furthermore, you also have to enter your Date of Birth and Contact information like Mobile Number.

Upload Required Documents: After filling out the application form, you need to upload all the required documents. Moreover, these important documents are Emirates ID, passport, Income Proof, and proof of Address.

Submit the application: After uploading documents, agree to terms and conditions then submit your application after carefully reviewing all details.

Verification Process: In this step, the bank will review your documents and also verify your identity. Furthermore, when your application is approved, you can receive your account number and other details via email or SMS.

Activate Online and Mobile Banking: At last, when your account is approved, you can easily register for online and mobile banking via the HDFC Bank portal.

Must Read: Discover Premium Banking Solutions with Mashreq Bank

FAQs

Which documents are essential to create an account with HDFC Bank in the UAE?

If you are willing to create an account with HDFC Bank then upload your Emirates ID, passport, Income Proof, and proof of Address.

What is the minimum balance requirement for a HDFC Bank account for customers?

It depends on the type of account if you want to create a savings account the minimum balance required is around AED 440.

Tell me the reason why it is important to create an account with the HDFC Bank?

If you create an account with HDFC Bank, you can access services like wealth management, NetBanking Mobile App, and more.