| Service | Details | Fees/Charges |

| Savings Account | Minimum balance requirement | AED 3,000 |

| Monthly maintenance fee | AED 25 (if balance falls below minimum) | |

| Interest rate | 1.5% per annum | |

| Current Account | Minimum balance requirement | AED 5,000 |

| Monthly maintenance fee | AED 50 (if balance falls below minimum) | |

| Fixed Deposits | Minimum deposit | AED 10,000 |

| Interest rate | 2.0% – 3.5% per annum | |

| Early withdrawal penalty | Varies based on tenure | |

| Personal Loans | Interest rate | Starting from 3.99% per annum |

| Processing fee | 1% of total loan amount (min AED 500) | |

| Late payment fee | AED 200 | |

| Home Loans | Interest rate | Starting from 2.99% per annum |

| Processing fee | 0.75% of the loan amount | |

| Early settlement fee | 1% of the outstanding amount | |

| Credit Cards | Annual fee | AED 200 – AED 1,000 |

| Interest rate | 2.99% – 3.49% per month | |

| Late payment fee | AED 250 | |

| Cash advance fee | 3% of the amount (min AED 100) | |

| Business Accounts | Minimum balance requirement | AED 10,000 |

| Monthly maintenance fee | AED 100 (if balance falls below minimum) | |

| Remittance Services | Domestic transfers | AED 5 – AED 25 |

| International transfers | AED 50 – AED 100 | |

| ATM Services | ATM withdrawal fee (own bank ATMs) | Free |

| ATM withdrawal fee (other bank ATMs) | AED 2 – AED 6 | |

| Cheque Book | First cheque book | Free |

| Additional cheque books | AED 25 per book | |

| Online Banking | Online banking access | Free |

| Fund transfer fee (within bank) | Free | |

| Fund transfer fee (other banks) | AED 2 – AED 5 |

In this digital age, Banks are one of the comfy and peaceful options that cater to the financial needs of every customer. Federal Bank Dubai, a leading institution allows you to manage your finances simply and easily in the UAE. Moreover, it was founded in 1984 and makes itself a reputable bank in the region due to its top-notch banking services. Furthermore, the commitment of the Bank to innovative banking solutions enhances the experience of every user. In this detailed blog, we will try to find out different services, account opening methods, and branches of Federal Bank Dubai.

Services Offered by Federal Bank Dubai

Wealth Management

Federal Bank Dubai allows you to avail services like mutual funds, bonds, and portfolio management. Moreover, in this prominent bank, customers can get advice from experts on investments and wealth creation.

NRI Banking Services

In the UAE, if customers choose Federal Bank Dubai then they can experience savings and fixed deposit accounts like NRE and NRO. Furthermore, the bank also allows you to experience fast and secure options for transferring money.

Digital Banking

In the UAE, if you choose Federal Bank Dubai then you can access banking services via the mobile application of the bank. Moreover, Federal Bank Dubai also allows you to transfer the money and pay bills 24/7 from anywhere in this country.

Federal Bank Dubai Branches in the UAE

| City | Location | Services | Contact No | Operating Hours |

| Dubai | Downtown Dubai | Full range of banking services | +971 4 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Abu Dhabi | Abu Dhabi city center | Personal and business banking | +971 2 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Sharjah | Sharjah city center | Personal and corporate banking | +971 6 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Al Ain | Al Ain city center | Full range of banking services | +971 3 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Ras Al Khaimah | Ras Al Khaimah city center | Personal and business banking | +971 7 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Ajman | Ajman city center | Personal and corporate banking | +971 6 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Fujairah | Fujairah city center | Full range of banking services | +971 9 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

| Umm Al Quwain | Umm Al Quwain city center | Personal and business banking | +971 6 123 4567 | From Sunday to Thursday: 8:00 AM to 3:00 PM, while Friday remains a closed day. |

How to Set Up an Account with Federal Bank Dubai

In-Branch Account Opening

If any user is willing to create an account with Federal Bank Dubai then visit their partner exchange house. Moreover, this method is a good option for those people who want face-to-face interaction.

Visit a Branch

For account opening purposes, the customer has to find the nearest Federal Bank Dubai exchange house in this country. Furthermore, for this, you can use their locator tool on the website or call customer support.

Carry Your Documents

Always remember to carry all required documents like Emirates ID, Valid Passport, UAE Visa, and Proof of address. It is important for NRI customers to bring their Pan Card.

Meet with the Bank Officer

Now you have to ask the officer of the bank, if I wish to create an account. Moreover, the officer will also guide you through the account options.

Fill Out the Account Opening Form

The next step is to take the form and fill it out by providing your Full name, date of birth, and nationality. Furthermore, you also have to write your contact information like address, email, and mobile number.

Submit the required Documents

After filling out the form, you have to provide copies of all required documents to the officer.

Verification Process

The officer of the bank makes an internal verification process of your documents to ensure your details are accurate. Moreover, this process normally happens in a few days.

Account Activation

At last, when your account is activated and ready for use the bank will provide your account number and other details. Moreover, after receiving a confirmation message remember to collect your banking materials like cheque book and debit card.

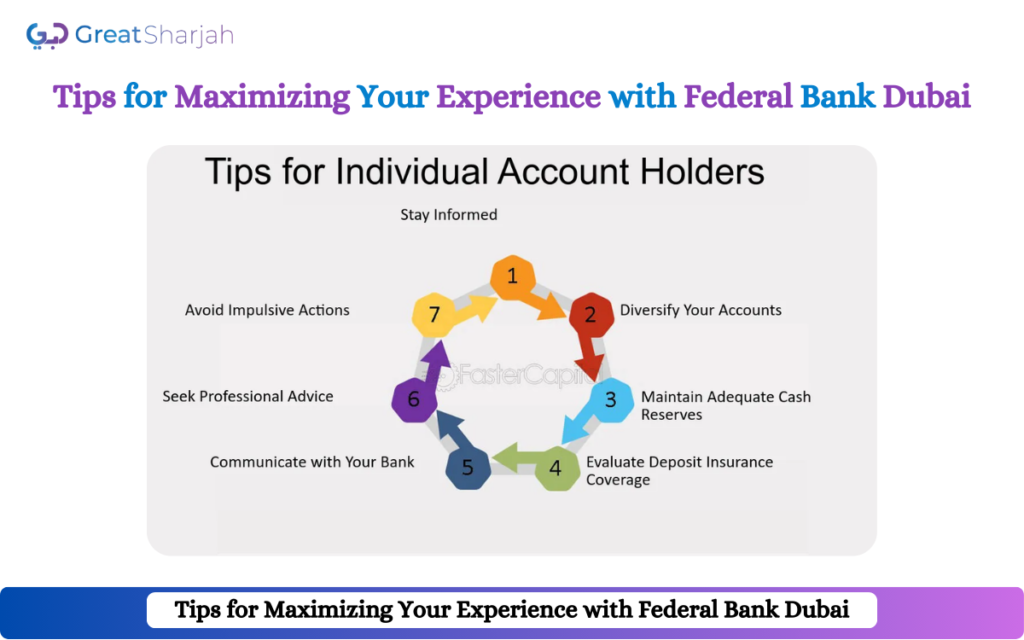

Tips for Maximizing Your Experience with Federal Bank Dubai

Leverage Digital Banking

It is handy to avail the option of Mobile app and online banking of Federal Bank Dubai to manage your finances.

Stay Updated on Promotions

It is good to check promotional offers on loans and credit cards of Federal Bank Dubai as it is helpful for extra rewards.

Monitor Account Fees

Always keep in mind to review the account statement as it is beneficial to avoid unexpected charges.

FAQs

Which method is best to create an account with Federal Bank Dubai in the UAE?

In the UAE, the Federal Bank Dubai partner exchange houses are one of the smart options to create an account.

Explain the reason why it is important to create an account with the Federal Bank Dubai?

If any customer creates an account with the Federal Bank Dubai it allows him to avail services like NRI Banking, wealth management, and loans.

Can users create an account with the Federal Bank Dubai Via partner exchange houses?

Yes, If anyone is willing to create an account with Federal Bank Dubai then visit nearest partner exchange houses. Moreover, for this purpose, the customer has to fill out an application form and provide all required documents like passport and Emirate ID.