For every owner of a business and employer, Banks play a crucial role in managing the finances. ICICI Bank is a prominent private financial institution that offers a wide range of services and innovative banking solutions. Moreover, it was founded in 1994 and has a trusted reputation due to its vast network and strong digital presence. The commitment of ICICI Bank to customer satisfaction and innovative financial products enhances your experience. In this detailed blog, we will explore services, the account opening process, and the branches of ICICI Bank in the United Arab Emirates.

ICICI Bank

| Account Type | Account Opening Fee | Monthly Maintenance Fee | Minimum Balance Requirement | Overdraft Charges |

| NRE Savings Account | AED 0 | AED 0 | AED 1,500 (approx.) | 1-2% monthly on overdraft amount |

| NRO Savings Account | AED 0 | AED 20 (if below balance) | AED 1,000 | 1-2% monthly on overdraft amount |

| FCNR Deposit Account | AED 0 | AED 0 | Varies by currency (e.g., $1000) | Not permitted |

| NRE Fixed Deposit | AED 0 | AED 0 | AED 1,000 | Not applicable |

| NRO Fixed Deposit | AED 0 | AED 0 | AED 1,000 | Not applicable |

| Recurring Deposit | AED 0 | AED 0 | AED 200 per month (approx.) | Not applicable |

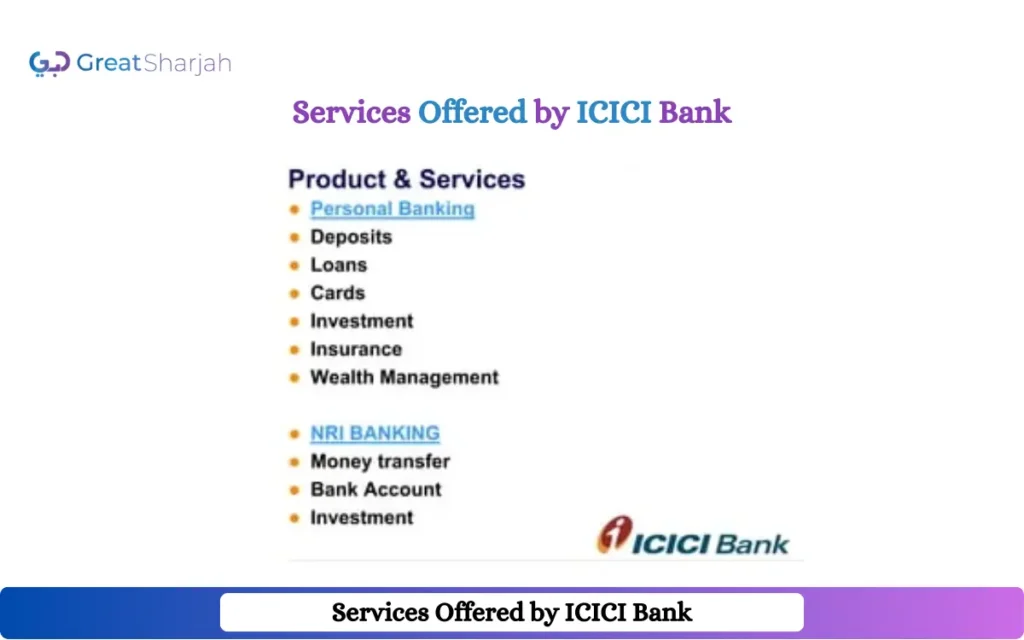

Services Offered by ICICI Bank

Business Banking

If you choose ICICI Bank then you can experience different business current accounts that smoothly handle your transactions. Furthermore, this leading sector also allows customers to avail top services like trade finance, cash management, and foreign exchange solutions.

Personal Banking

ICICI Bank offers a wide range of NRE, NRO, and FCNR accounts that cater to the banking needs of customers. In this private bank, you can avail the option of home loans and loans against property. Moreover, here you can also experience insurance and wealth management services.

ICICI Bank Branches in the UAE

| City | Branch | Services | Contact No. | Operating Hours |

| Dubai | ICICI Bank – Sheikh Zayed Road | Savings, Current, Loans, Credit Cards | +971 4 313 1200 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Dubai | ICICI Bank – Dubai Marina | Savings, Current, Loans, Credit Cards | +971 4 399 3210 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Abu Dhabi | ICICI Bank – Al Reem Island | Savings, Current, Loans, Credit Cards | +971 2 632 2630 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Sharjah | ICICI Bank – Al Gulaya’a | Savings, Current, Loans, Credit Cards | +971 6 573 1110 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Ajman | ICICI Bank – Al Nuaimia | Savings, Current, Loans, Credit Cards | +971 6 742 4444 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Ras Al Khaimah | ICICI Bank – Al Nakheel | Savings, Current, Loans, Credit Cards | +971 7 228 4888 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

| Fujairah | ICICI Bank – Fujairah City Center | Savings, Current, Loans, Credit Cards | +971 9 223 2200 | Sun – Thu: 9:00 AM – 6:00 PM, Fri: 9:00 AM – 12:00 PM |

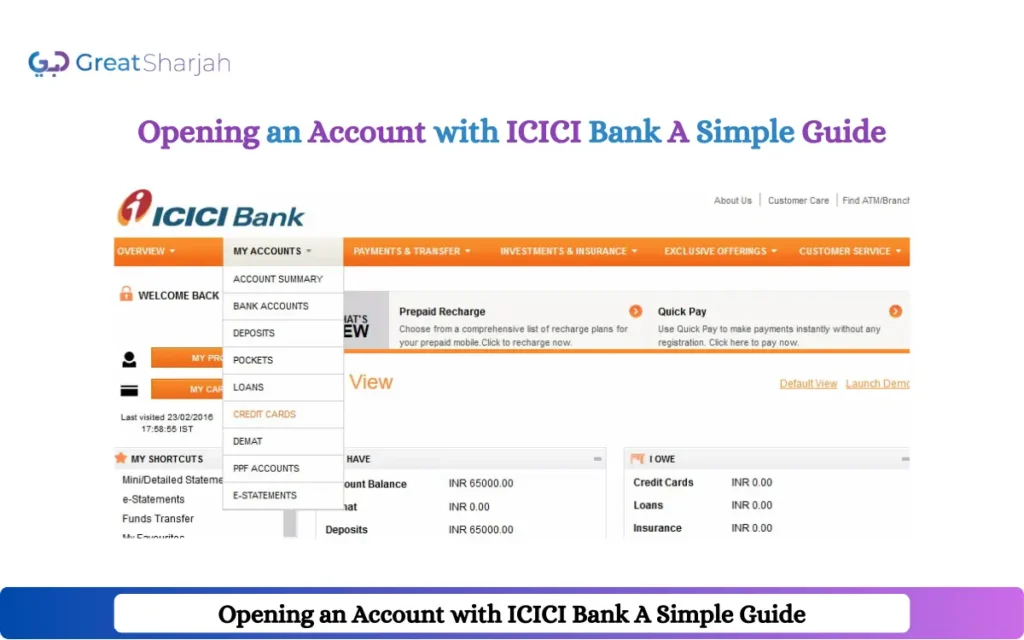

Opening an Account with ICICI Bank: A Simple Guide

Mobile App

One of the straightforward and peaceful ways to create an account with ICICI Bank is their mobile app. Moreover, this process includes some simple but main steps.

Download the ICICI Bank App: To create an account, the ICICI Bank Mobile Banking app is available on the Apple Store or Google Play Store. Furthermore, you need to download and install the app on your mobile phone.

Register as a New User: After installing, you have to open the app and simply click the option for New User Registration. Moreover, here you have to register yourself, if you are already linked then enter your registered mobile number.

Select the Account Type: After registration, you need to select the type of account that you desire to create with the ICICI Bank.

Upload Required Documents: In this step, you have to upload documents which are a Passport, Emirate ID, and Residence Visa. Moreover, you may also have to take a selfie for identity verification

Set up Account Details: After that, you have to set up your account PIN, mobile banking credentials, and transaction limits.

Account Activation: At last, you have to log in to the app for the first time and remember to set up security questions.

More Banking Related Guides:

- Step-by-Step Guide to Opening an HDFC Bank Account

- Dubai Islamic Bank: Experience the Power of Halal Finance

- RAK Bank – Your Trusted Partner in Finance

FAQs

What is the reliable way to create an account with ICICI Bank in the UAE?

In the UAE, the ICICI Bank Mobile Banking app is one of the reliable ways to create an account.

Which essential documents are required to create an account with ICICI Bank?

If you are aiming to create an account with ICICI Bank then you must have your Passport, Emirate ID, Address Proof, and selfie for verification.

Why is it important to create an account with ICICI Bank?

If you create an account with ICICI Bank it allows you to access a wide range of NRE, NRO, and FCNR accounts. Moreover, it also provides services like trade finance, cash management, and foreign exchange solutions.